How to see an owner’s entire property portfolio in one place

Stop getting stonewalled by LLCs and access portfolio information in one fell swoop.

The best way to learn about a multi family or commercial property owner? Analyze their property portfolio. Historically, that would have taken a bundle of resources and a great deal of time. But that’s not the case anymore.

In this article, we’ll look at how to use Reonomy to quickly analyze an owner’s entire portfolio, the value you can derive from certain pieces of information while showing you how to get the contact information of those owners and reach out directly.

Finding an owner’s property portfolio

What is a portfolio?

Simply put, a property portfolio is the full summary of all the properties owned by one party—which could be one person, a small group, or company of any size.

Who analyzes owner property portfolios?

In the CRE industry, investors, brokers, and service providers can all analyze full property portfolios to get ahead of their competitors and build long-lasting relationships with clients and business partners.

Investors can analyze owner portfolios to:

Identify and understand potential sellers.

Find other investors with similar portfolios to their own.

Brokers can analyze ownership portfolios to:

Identify property sellers.

Identify property buyers.

Service providers can analyze an ownership portfolio to:

Find prospect owners with multiple properties that need servicing.

Up-sell an existing client that may have an illustrious portfolio.

Investors, brokers, and service providers can use the insights they gain from researching a portfolio to essentially score a prospect’s worthiness of pursuit, and then use those insights to build hyper-personalized messaging.

How to find and analyze property portfolios with Reonomy

You can access owner property portfolios on Reonomy from any starting point. If you’re an investor, broker, or service provider trying to analyze full portfolios, you’ll likely fall into one of the three categories below:

You know an owner and want to research their portfolio and contact info.

You have the address of a property but no owner name.

You don’t have any information, and want to source brand new prospect portfolios.

Whatever the case is, you can very easily access property portfolios across the country. It may simply take an extra step or two on the Reonomy platform. If you know the name or mailing address of an owner or owning entity, then the process is incredibly simple.

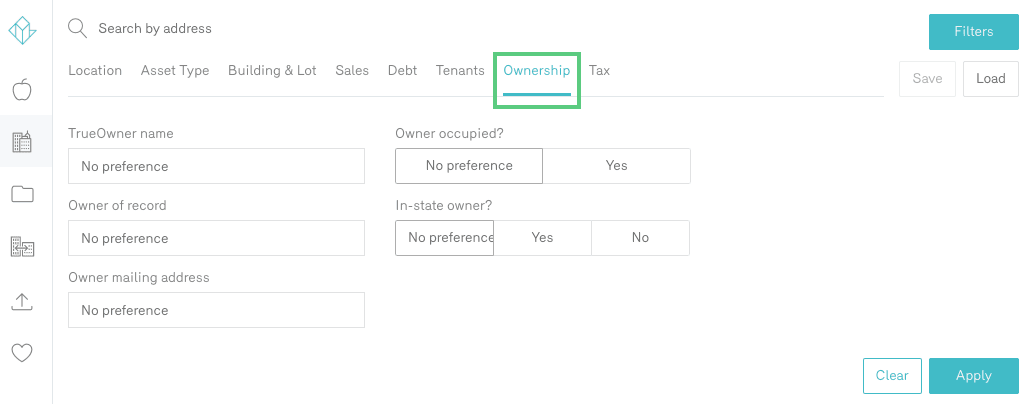

All you need to do is visit the Ownership tab of the Reonomy Platform, and enter the name of a person, company, or enter a mailing address.

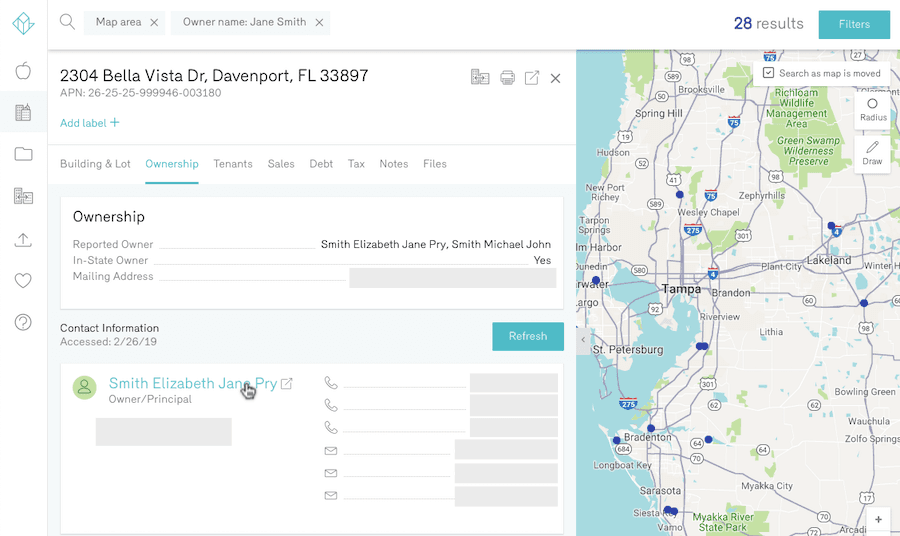

Once you search, you’ll be given a list of properties—all of the properties associated with your searched name in some capacity.

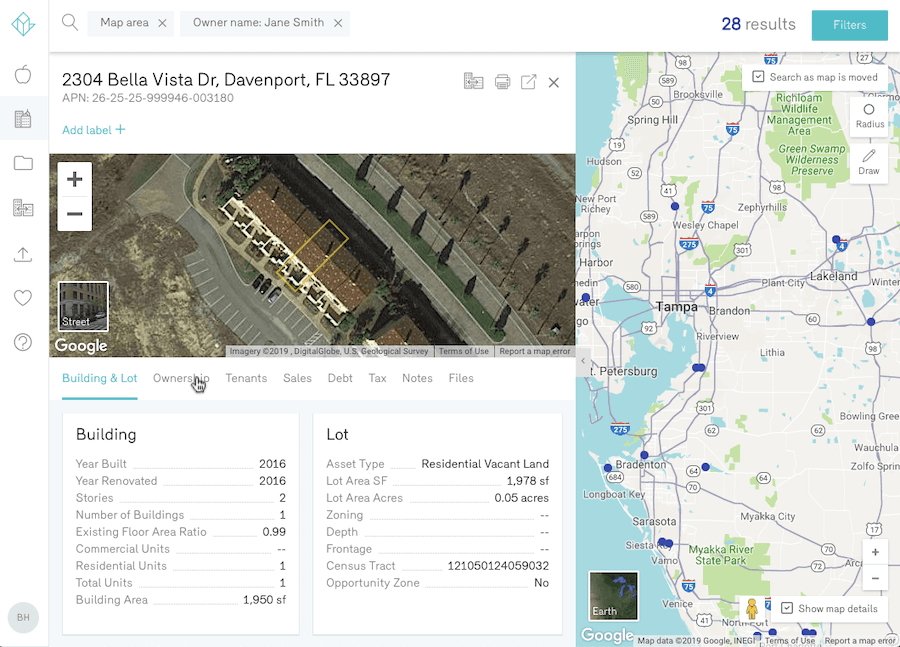

From that list, you can click into individual property profile pages and analyze the building and lot, sales, debt, and tenant information of that property. You can also see what other owners may be involved with the property, or see the LLC in which your owner of interest uses for that property in particular.

In the Ownership tab, you’ll also be able to see the contact information of the owner—which includes the individuals apart of an owning-LLC.

You can do this for as many properties as there are in your list of results to gain as much intel as possible, while also assuring that the properties in your list are your exact owner of interest, and not a similarly named party.

Finding property portfolios without an owner name

Scenario 1: Starting from scratch

To start from scratch, you can begin with a property search for any asset class above a single-family home, including land and special use property.

By finding properties based on their physical, financial, and transactional makeup, you can quickly identify potential prospects and then dive into the individual owners as you would above. In this case, however, upon visiting the Ownership tab, when seeing who the owner is, you can simply click the name of the owner, and Reonomy will automatically run a property owner search for that name.

There, you’ll be taken to a list of properties associated with the owner of the property.

Scenario 2: Start with an address, but no owner name

To start with an address, you can simply enter the exact address of the location you’d like to look at in the Reonomy search bar.

From there, you’ll be taken straight to the individual profile page of that property, where, like above, you can visit the Ownership tab to see who the owner is, then run a quick search using that name.

Then, when looking at properties, you can dive into the building and lot specs, sales history, debt history, tenant information, and more to begin forming insights and identifying opportunities. If you have a list of properties from an owner that are of interest, you can also export that list to use elsewhere.

What can you learn from an owner’s property portfolio?

There is a ton that can be learned from property portfolio research and analysis.

See if and where an owner focuses geographically

By analyzing an owner’s full list of properties, you can see whether or not they have a main geographic focus. Perhaps they have a very narrow focus. Maybe they own property across many states. Maybe an owner focuses primarily on properties in Opportunity Zones. Seeing the locations of their properties can help you find new local buildings to service, or decipher whether or not an investor would be interested in buying a certain property. It can also simply help you locate extra buying or servicing opportunities that are nearby.

See what kind of assets an owner focuses on

Similar to the above, you can also see whether an owner has a specific asset class they invest in or operate out of. If they do, you can also see if they gravitate towards properties of certain square footages, units, acres, and so on. This can help you qualify prospects in the same ways you would based on their location, and serves a notable benefit for service providers looking to offer their services to owners. With Reonomy, roofers, cleaners, solar installers, and contractors can see roof types, property layouts, number of floors, units, building area and more to know whether a property it is one they should connect with.

See what an owner’s buying budget is

If you’re trying to find commercial or multi family buyer leads, you can use an owner’s property portfolio to see their buying history, and therefore, what their budget could be.

See how long an owner has had their properties

You can glean a few things from seeing how long someone has owned a property for. By looking at the asset type and time of ownership, you can learn a bit about the owner’s income on a property. See if the property was a fix-and-flip or if it was a long-term rental income-driven asset. When looking at all of the properties that someone owns, you can also compare the time lengths of ownership against one another.

For example, maybe a multi family property owner in Virginia has six properties, one of which they’ve owned for 12 years, all others being properties they’ve owned for 6 years or less. In an off-market setting, the owner will likely be much more willing to part with the 12-year-owned property.

Whether or not they’ve recently purchased a property

Another major plus for service providers, looking at an owner property portfolio can tell you whether they have recently bought any properties (and if so, how many). This insight can be leveraged in a timely manner to up-sell an existing client who may be adding properties to their portfolio.

If they have multiple properties that can be serviced, sold, or bought

Obviously, when researching a property portfolio, you can see how many properties an owner has. This, paired with the insights mentioned above, let you see whether or not an owner will be a long-time client, and if they’re a client that can bring you a single, yet large stream of revenue. For example, let’s say you’ve identified two very similar assets. The owner of Property 1 has a portfolio of three office buildings. The owner of Property 2 has a portfolio of thirteen office buildings.

In this case, it may take the same amount of effort to connect to an owner, but get three or four times the amount of business. All of these insights are only scratching the surface, as well. When getting into more granular breakdowns of owners, and looking specifically at sales, debt, building, owner, and tenant information, the layers continue to pile up, and so does the informational value of a property portfolio.

Other ways to find an owner’s property portfolio

Other than Reonomy, there are two main ways to find an owner’s portfolio.

Search your County’s public records: Most counties now have online search tools to find property documents of different kinds.

Conduct online research on social media and company websites: By visiting LinkedIn profiles or the “Portfolio” sections of investment firm websites, you can gain a bit of information on specific owners.

These sources, while helpful, do not present the flexibility and scalability of Reonomy, and most of the time, will be extremely hard to navigate without an address or owner names.

What can you learn from an owner’s property portfolio?

There is a ton that can be learned from property portfolio research and analysis.

See if and where an owner focuses geographically

By analyzing an owner’s full list of properties, you can see whether or not they have a main geographic focus. Perhaps they have a very narrow focus. Maybe they own property across many states. Maybe an owner focuses primarily on properties in Opportunity Zones. Seeing the locations of their properties can help you find new local buildings to service, or decipher whether or not an investor would be interested in buying a certain property. It can also simply help you locate extra buying or servicing opportunities that are nearby.

See what kind of assets an owner focuses on

Similar to the above, you can also see whether an owner has a specific asset class they invest in or operate out of. If they do, you can also see if they gravitate towards properties of certain square footages, units, acres, and so on. This can help you qualify prospects in the same ways you would based on their location, and serves a notable benefit for service providers looking to offer their services to owners. With Reonomy, roofers, cleaners, solar installers, and contractors can see roof types, property layouts, number of floors, units, building area and more to know whether a property it is one they should connect with.

See what an owner’s buying budget is

If you’re trying to find commercial or multi family buyer leads, you can use an owner’s property portfolio to see their buying history, and therefore, what their budget could be.

See how long an owner has had their properties

You can glean a few things from seeing how long someone has owned a property for. By looking at the asset type and time of ownership, you can learn a bit about the owner’s income on a property. See if the property was a fix-and-flip or if it was a long-term rental income-driven asset. When looking at all of the properties that someone owns, you can also compare the time lengths of ownership against one another.

For example, maybe a multi family property owner in Virginia has six properties, one of which they’ve owned for 12 years, all others being properties they’ve owned for 6 years or less. In an off-market setting, the owner will likely be much more willing to part with the 12-year-owned property.

Whether or not they’ve recently purchased a property

Another major plus for service providers, looking at an owner property portfolio can tell you whether they have recently bought any properties (and if so, how many). This insight can be leveraged in a timely manner to up-sell an existing client who may be adding properties to their portfolio.

If they have multiple properties that can be serviced, sold, or bought

Obviously, when researching a property portfolio, you can see how many properties an owner has. This, paired with the insights mentioned above, let you see whether or not an owner will be a long-time client, and if they’re a client that can bring you a single, yet large stream of revenue. For example, let’s say you’ve identified two very similar assets. The owner of Property 1 has a portfolio of three office buildings. The owner of Property 2 has a portfolio of thirteen office buildings.

In this case, it may take the same amount of effort to connect to an owner, but get three or four times the amount of business. All of these insights are only scratching the surface, as well. When getting into more granular breakdowns of owners, and looking specifically at sales, debt, building, owner, and tenant information, the layers continue to pile up, and so does the informational value of a property portfolio.

Other ways to find an owner’s property portfolio

Other than Reonomy, there are two main ways to find an owner’s portfolio.

Search your County’s public records: Most counties now have online search tools to find property documents of different kinds.

Conduct online research on social media and company websites: By visiting LinkedIn profiles or the “Portfolio” sections of investment firm websites, you can gain a bit of information on specific owners.

These sources, while helpful, do not present the flexibility and scalability of Reonomy, and most of the time, will be extremely hard to navigate without an address or owner names.

Author

Reonomy

Resources team

Author

Reonomy

Resources team